Navigating the Landscape of Property Ownership: A Guide to the Wakefield, NH Tax Map

Related Articles: Navigating the Landscape of Property Ownership: A Guide to the Wakefield, NH Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of Property Ownership: A Guide to the Wakefield, NH Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Property Ownership: A Guide to the Wakefield, NH Tax Map

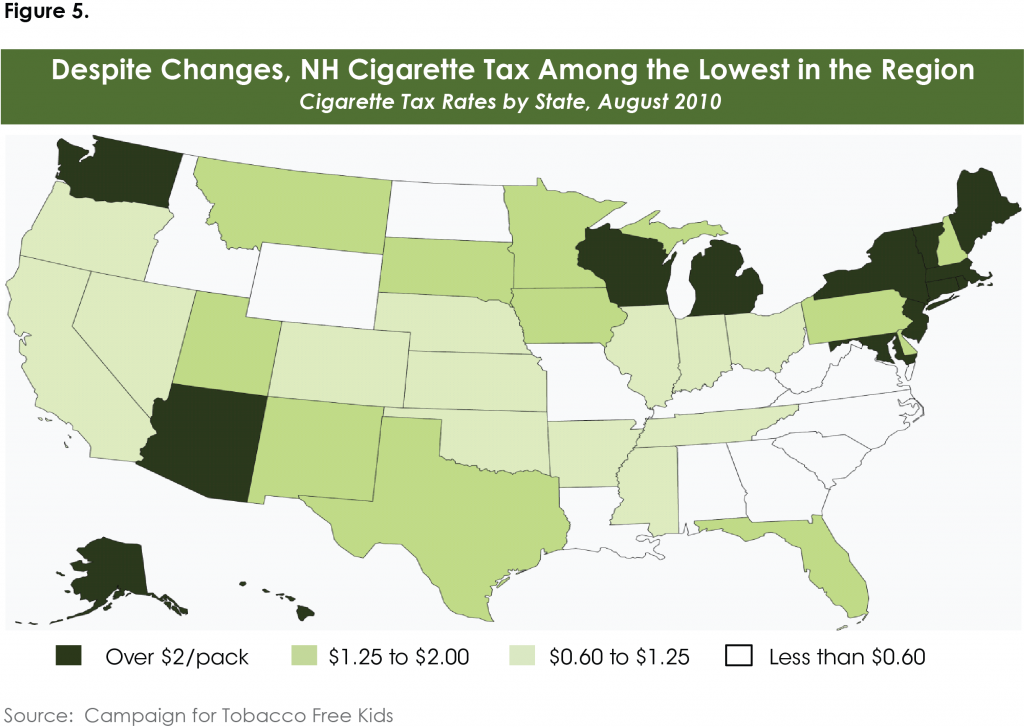

Understanding the intricate web of property ownership within a community is essential for both residents and those considering investment. In Wakefield, New Hampshire, this intricate web is meticulously documented and visualized through the Wakefield Tax Map. This comprehensive tool serves as a vital resource for a multitude of stakeholders, from homeowners seeking information about their properties to developers assessing potential investment opportunities.

The Foundation of Property Information: Understanding the Wakefield Tax Map

The Wakefield Tax Map is a visual representation of the town’s properties, providing a detailed overview of their geographical locations, ownership details, and associated tax information. This map is not merely a static document; it is a dynamic tool that is regularly updated to reflect changes in property ownership, assessed values, and other relevant data. Its importance lies in its ability to provide a clear and accessible understanding of the town’s property landscape, enabling informed decision-making for various purposes.

Decoding the Map: Key Elements and Their Significance

The Wakefield Tax Map is structured to facilitate easy navigation and interpretation. Key elements within the map include:

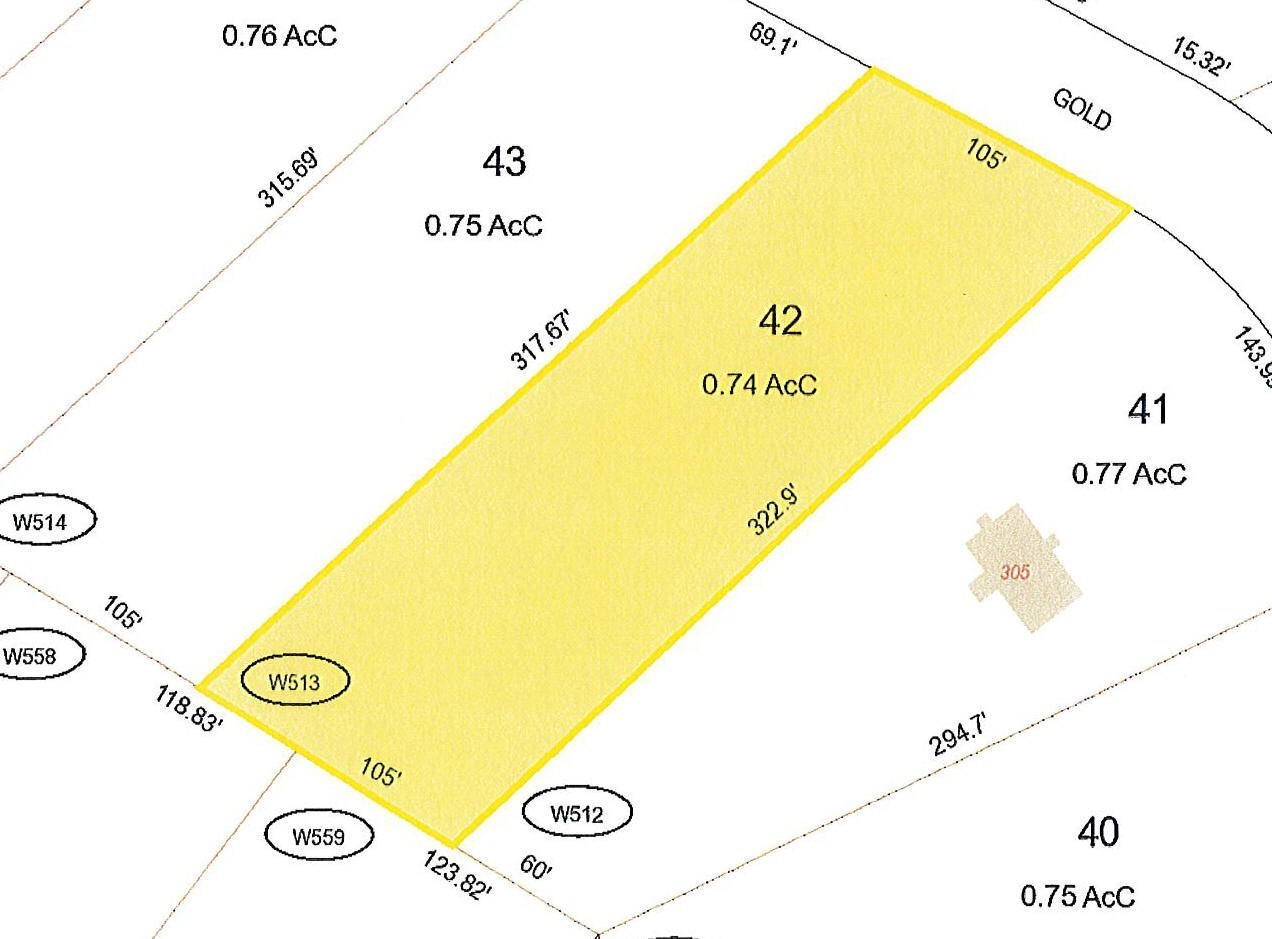

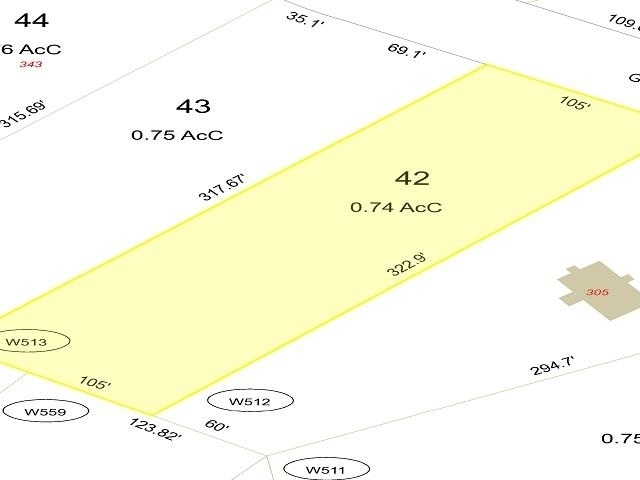

- Property Boundaries: Each property is delineated with precise boundaries, clearly defining its physical extent. This allows for accurate identification of individual parcels and their relationship to surrounding properties.

- Property Identification Numbers: Each property is assigned a unique identification number, serving as a primary identifier for recordkeeping and referencing.

- Property Ownership Information: The map displays the names of property owners, providing a readily accessible record of ownership details.

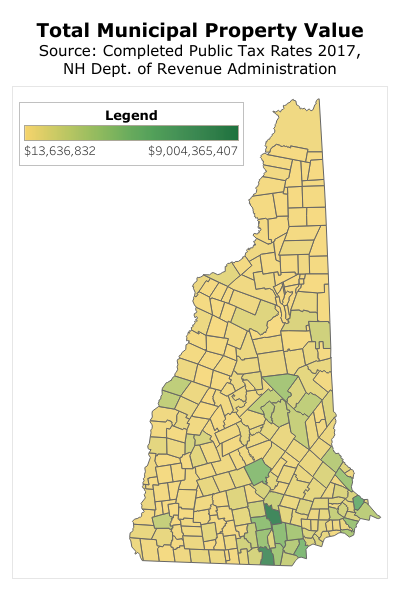

- Assessed Values: The assessed value of each property is indicated on the map, reflecting its estimated market value for tax purposes.

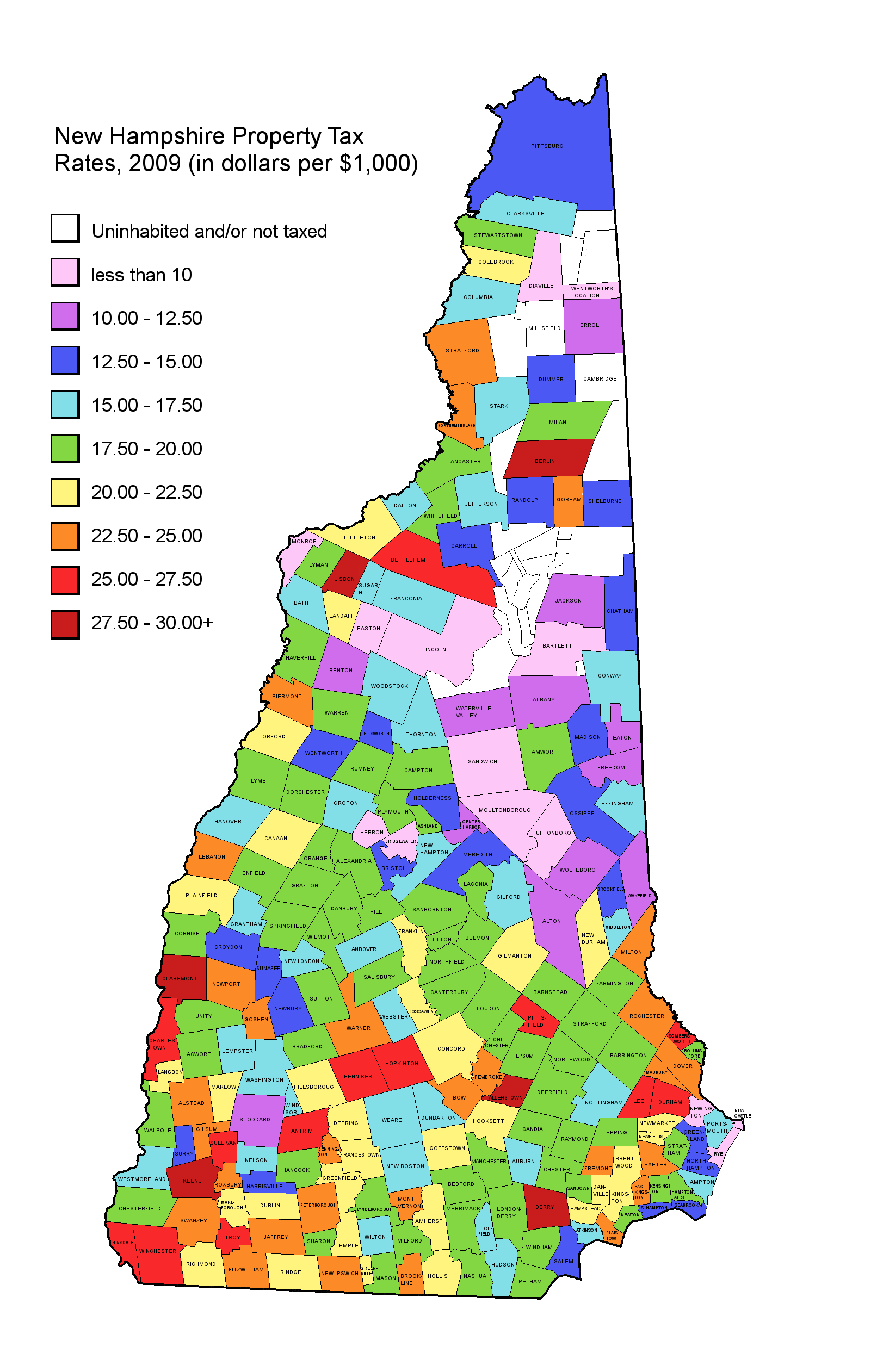

- Tax Rates: The map may also include information about the current tax rates applicable to different property types, providing a comprehensive understanding of tax obligations.

Beyond the Visual: Accessing Detailed Property Information

While the Wakefield Tax Map provides a valuable visual overview, it serves as a gateway to a wealth of detailed information about individual properties. This information can be accessed through various channels, including:

- Town Assessor’s Office: The Town Assessor’s office maintains comprehensive records about each property, including its legal description, history of ownership, and current assessed value. This office is the primary source of detailed information for individuals seeking in-depth data about specific properties.

- Online Databases: The town may offer online access to its property database, allowing residents and interested parties to search for information about specific properties using the property identification number or owner’s name.

- GIS Mapping Systems: The town may utilize Geographic Information Systems (GIS) to create interactive maps that allow users to explore property information in a dynamic and user-friendly manner.

Benefits of the Wakefield Tax Map: A Multifaceted Resource

The Wakefield Tax Map offers a range of benefits for various stakeholders, including:

- Homeowners: The map provides homeowners with a clear understanding of their property boundaries, assessed value, and tax obligations. This information can be crucial for making informed decisions about property maintenance, renovations, and potential sales.

- Real Estate Professionals: Real estate agents and brokers utilize the map to identify properties, assess their market value, and develop targeted marketing strategies. The map facilitates efficient property searches and provides valuable insights for pricing and negotiations.

- Developers and Investors: Developers and investors rely on the map to identify potential development sites, assess their suitability, and evaluate the associated costs and tax implications. The map provides a comprehensive overview of available properties and their characteristics.

- Town Officials: The map serves as a fundamental tool for town officials, enabling them to manage property records, assess tax revenue, and plan for future development. The map provides a detailed understanding of the town’s property landscape, facilitating informed decision-making for various municipal functions.

FAQs: Addressing Common Queries about the Wakefield Tax Map

1. How can I access the Wakefield Tax Map?

The Wakefield Tax Map can typically be accessed through the town’s website, the Town Assessor’s office, or local real estate agencies.

2. How frequently is the Wakefield Tax Map updated?

The Wakefield Tax Map is typically updated annually to reflect changes in property ownership, assessed values, and other relevant data.

3. What information is not included on the Wakefield Tax Map?

While the map provides a comprehensive overview of property information, it may not include details about specific property features, such as the presence of easements or zoning restrictions.

4. Can I use the Wakefield Tax Map to determine the current market value of a property?

The Wakefield Tax Map displays the assessed value of properties, which may not necessarily reflect the current market value. For an accurate estimate of market value, it is recommended to consult with a real estate professional or utilize independent valuation services.

5. What are the implications of changes in property ownership on the Wakefield Tax Map?

When a property changes ownership, the map is updated to reflect the new owner’s name and contact information. This ensures accurate recordkeeping and facilitates communication between the town and property owners.

Tips for Effective Utilization of the Wakefield Tax Map

- Familiarize yourself with the map’s key elements: Understand the different symbols, colors, and notations used on the map to effectively interpret property information.

- Utilize online resources: Take advantage of the town’s website or online databases for accessing detailed property information beyond the visual representation of the map.

- Contact the Town Assessor’s office: If you have specific questions or require clarification regarding property information, contact the Town Assessor’s office for assistance.

- Consider consulting a real estate professional: For complex property-related inquiries, consulting a real estate agent or broker can provide expert guidance and insights.

Conclusion: The Wakefield Tax Map – A Cornerstone of Property Information

The Wakefield Tax Map stands as a cornerstone of property information within the town, providing a clear and accessible visual representation of its property landscape. Its significance extends beyond a simple visual tool; it serves as a dynamic resource for various stakeholders, facilitating informed decision-making, efficient property management, and a comprehensive understanding of the town’s property ownership landscape. By leveraging the information provided by the Wakefield Tax Map, residents, investors, and town officials alike can navigate the complexities of property ownership and contribute to the continued growth and prosperity of the community.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Property Ownership: A Guide to the Wakefield, NH Tax Map. We hope you find this article informative and beneficial. See you in our next article!